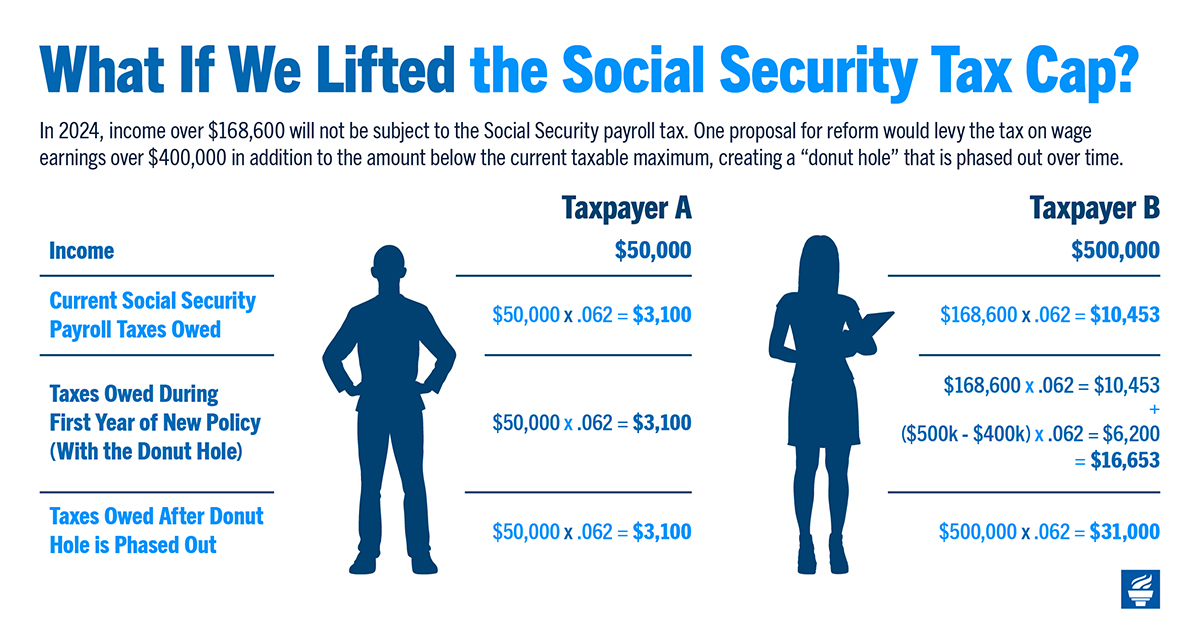

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

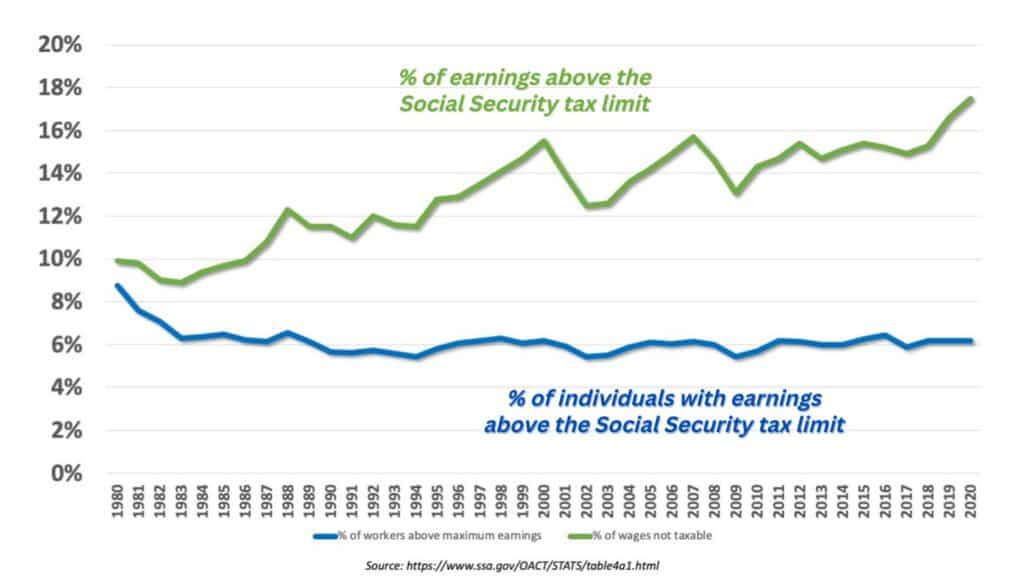

Richard Angwin on X: "The social security earnings cap is a subsidy for the wealthy. Ending it would close the funding gap and make social security permanently solvent. #EndTheCap https://t.co/UhINVK7yPH" / X

T08-0001 - Options to Adjust Social Security Earnings Cap, Static Impact on Individual Income and Payroll Tax Liability and Revenue ($ billions), 2009-18 | Tax Policy Center

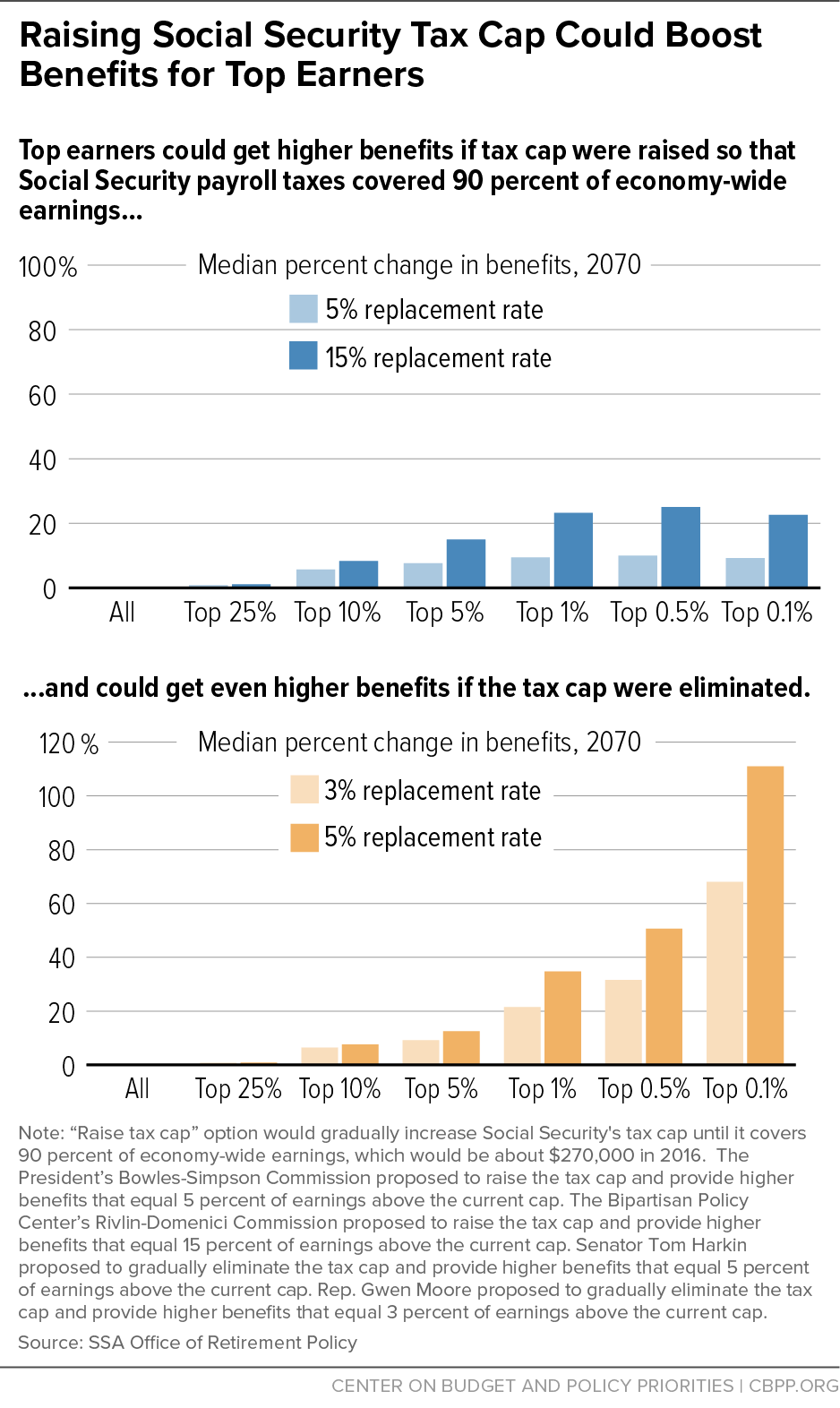

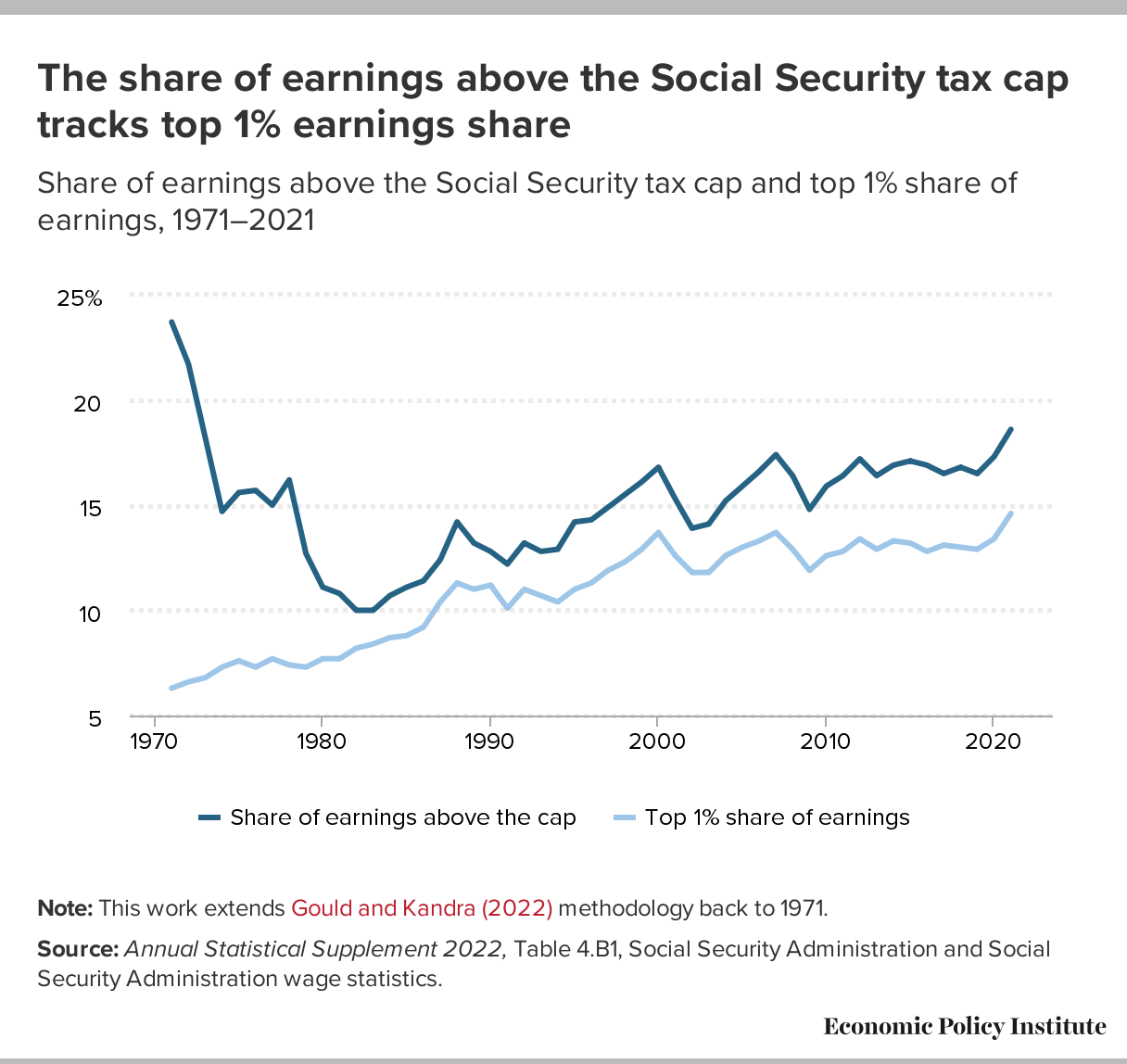

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

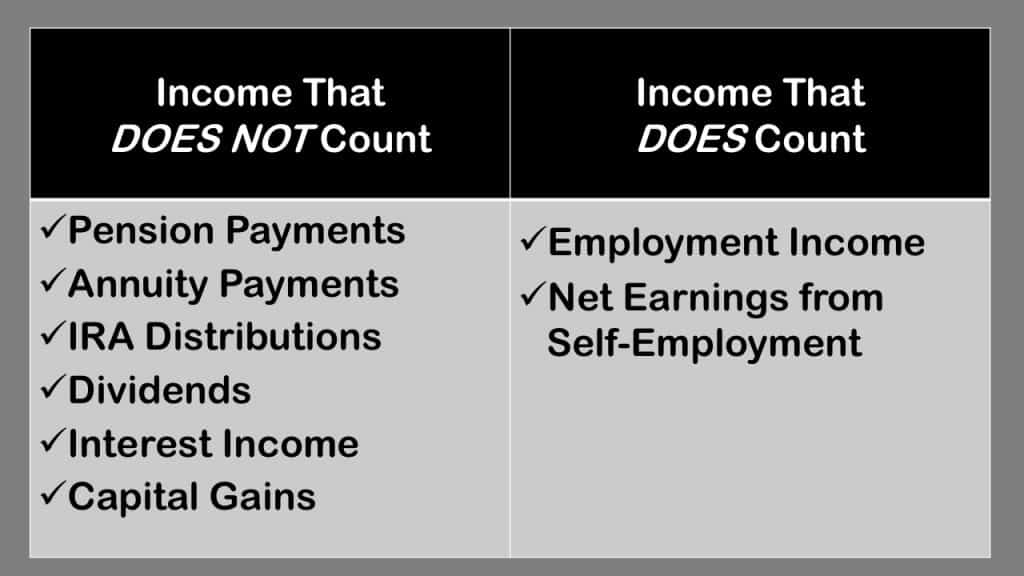

![Social Security Earnings Limit [UPDATED] - YouTube Social Security Earnings Limit [UPDATED] - YouTube](https://i.ytimg.com/vi/tX8mJUnJUkA/sddefault.jpg)